2026 Construction Outlook: Dampening Outlook With Some Potential Bright Spots

According to Dodge Construction Network’s Outlook 2026 Ebook, “the construction industry came roaring into 2025” – with large government investments through the Infrastructure Bill and the CHIPS Act (promoting investment in the domestic semiconductor industry), as well as outsized spending on data centers to support cloud and AI technology – but “throttled back significantly” due to “rapid changes to economic and fiscal policies.”

These changes include short-term cost impacts due to tariffs and labor impacts due to the federal government’s immigration crackdown and long-term concerns following enactment of the One Big Beautiful Bill (OBBBA) which is anticipated to add $3.4 trillion to the federal deficit over ten years.

The Congressional Budget Office (CBO) estimates that the OBBBA adds $3.4 trillion to budget deficits over ten years, increasing the debt-to-GDP ration from around 100% noons to about 130% in ten years with spending cuts from student loan payment-plan changes, phasing out of Inflation Reduction Act (IRA) tax credits, and Medicaid cuts reducing costs by only 30% . . . This will exacerbate income and wealth inequality, which has been increasing since the 1980s, likely tackling into the housing market by pricing out middle- and lower-income buyers and decreasing demand for new single-family housing. However, the low-income housing tax credit may provide some offset.

***

The largest direct impact on the construction industry comes through the massive increase in the Immigration and Customs Enforcement agency (ICE), which will lead to large volumes of deportations. Estimates of foreign-born labor within the construction industry are about 20% of the workforce; however, in some states, the number is closer to 35-40%.

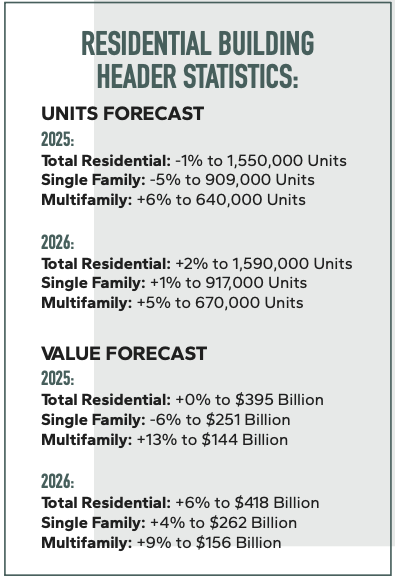

Due to these changes the report warns of a sizable downside risk in the near term for construction activity with consumer spending expected to slow down, from 2.8% growth in 2024 to 2.1% in 2025 and 1.1% in 2026, and with unemployment ticking up from 4.0% in 2024 to 4.2% on average in 2025 and 4.7% in 2026. Overall, the report suggests that total construction activities will grow 4% to $1.26 trillion, but with much of that growth focused on specific segments of the industry, like data centers and power generation.

According to the report:

According to the report, single-family home prices remain historically high, and with 30-year fixed mortgage rates firmly in the 6.5% to 7% range, and the growing risk of recession and a weakening labor market dampening demand, single-family starts are expected to grow 4% to $262 billion. As buyers continue to be priced out of the single-family market, demand for rental side will be sustained, and multifamily starts are are expected to grow 9% to $156 billion.

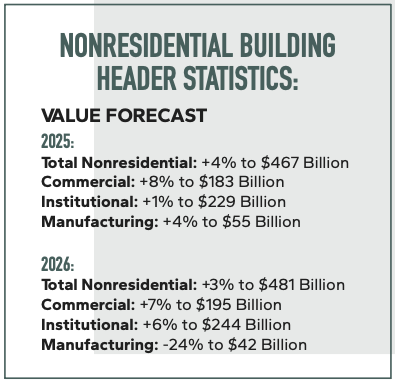

Nonresidential construction, which encompasses a wide range of uses from commercial buildings, retail stores, warehouse, to hotels, will see some notable growth but also some notable declines.

Growth areas include continued strength in data center construction as well, perhaps surprisingly, parking garages. However, retail stores, warehouses, and hotels will have more vulnerability as a result of lower consumer spending, more stringent lending, and higher material costs.

Institutional starts will be a bright spot with several large projects set to begin including the Rikers Island prison replacement and the Midtown Port Authority Bus Terminal Replacement in New York, NY. However, educational construction is expected to be weak as risks to federal funding and endowments increase. Hospital construction is expected to be well insulated.

Increasing and uncertain tariff policies are expected to have a large negative impact on manufacturing construction with manufacturing starts expected to be down 24% to $42 billion.

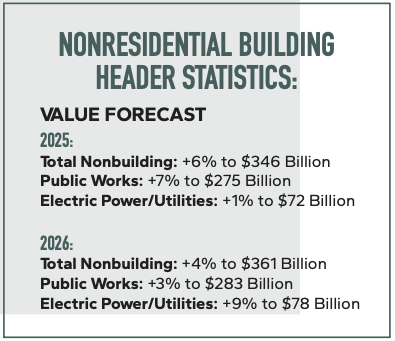

Total nonbuilding infrastructure starts are expected to expand 4% to $361 billion, but is expected to moderate in 2027, as funds from the Infrastructure Bill dry up.

One of the larger downgrades is in electric power-related construction. Solar and wind projects accounted for 71% of electric power starts in 2024 but are now facing weaker federal funding and the expiration of tax credits. However, nuclear and combined-cycle natural gas plants are expected to grow as demand increases due to the construction of data centers and high-tech manufacturing.

All in all, public works construction starts are expected to increase 3% to $283 billion and electric power/utility starts are expected to increase 9% to $78 billion.

The Dodge Outlook 2026 Ebook can be downloaded here.

Leave a comment