Shaken? Stirred? A Primer on License Bond Claims in California

Shaken?

Stirred?

A bit hot under the tuxedo collar perhaps?

Maybe it’s time for a martini. Or two.

When your project’s a mess, your contractor isn’t returning your calls, and you don’t have a license to kill it’s only natural that you would want to go after that other license: the contractor’s license bond.

However, except for smaller claims, or situations where you discover that the contractor is or might be judgment-proof, going after a contractor’s license bond isn’t necessarily the panacea many might hope it to be. Read on to learn why.

What is a license bond?

First, a license bond is not insurance. While insurance is typically limited to property damage and personal injury, a license bond covers a contractor’s violation of the Contractors State License Law. All California contractors are required to have on file a license bond (or, alternative, such as a cash deposit) with the California Contractors State License Board (“CSLB”).

What is the amount required of a license bond?

So, here’s the rub, or at least one of them. The amount of a license bond is relatively small. The current amount required of a license bond is $15,000.

In addition, the CSLB can require as a condition of licensure of a contractor which has had its contractor’s license suspended or revoked that the contractor have on file a disciplinary bond in an amount of no less than $15,000 nor more than $150,000 depending on the seriousness of the violation which led to the suspension or revocation of the contractor’s license.

And, finally, where the qualifying individual is neither the sole proprietor, general partner, or joint licensee of the contractor – or is a responsible managing officer (RMO) of a corporation and holds less than 10% of the voting stock of the corporation or is responsible managing member (RMM) of a limited liability and holds less than 10% of the membership interests of the limited liability company – a qualifying individual bond must be filed in the current amount of $12,500.

Who can make a claim against a license bond?

Here’s another rub. Only certain “classes” of claimants may make a claim against a license bond and those are:

- Homeowners contracting for home improvements upon the homeowner’s personal family residence who has been damaged as a result of the contractor’s violation of the Contractors State License Law.

- Property owners contracting for the construction of a single-family dwelling who has been damaged as a result of the contractor’s violation of the Contractors State License Law but only if the single-family dwelling was not intended for sale or offered for sale at the time damages were incurred.

- Persons damaged as a result of the willful and deliberate violation of the Contractors State License Law.

- Employees of the contractor damaged as a result of the contractor’s failure to pay wages.

- Laborers, including entities, to whom a portion of the compensation of the employee is paid by agreement with the employee or the collective bargaining agent of the employee, damaged as a result of the contractor’s failure to pay fringe benefits including, but not limited to, health and welfare, pension, vacation, travel, and subsistence.

Note: Subcontractors, material suppliers, and equipment lessors may also make claims against a license bond but only if they can show that the contractor engaged in a “willful and deliberate violation” of the Contractors State License law..

What violations of the Contractors State License Law are subject to claims against a license bond?

There are too many to list here. However, the most common are:

- B&P Code §7107: Abandonment of a construction project or operation without legal excuse.

- B&P Code §7108: Diversion or misapplication of funds or property received for prosecution or completion of a construction project or operation.

- B&P Code §7108.5: Failure to pay a subcontractor not later than 7 days after receipt of each progress payment, unless otherwise agreed to in writing or in the absence of a good faith dispute over the amount due.

- B&P Code §7109: Willful departure from or disregard of accepted trade standards or plans and specifications.

- B&P Code §7113: Failing to complete a construction project or operation for the price stated in the contract or in any modification to the contract.

- B&P Code §7114: Aiding or abetting an unlicensed person with an intent to evade the License Law.

- B&P Code §7117.6: Acting in the capacity of a contractor in a classification other than a classification currently held.

- B&P Code §7118: Entering into a contract with an unlicensed contractor.

- B&P Code §7119: Willful failure or refusal to to diligently prosecute a construction project or operation without legal excuse.

- B&P Code §7120: Willful or deliberate failure to pay money when due for materials or services rendered or false denial of any amount due or the validity of a claim with intent to secure a discount or delay.

Are there any limitations on the amount which can be recovered against a license bond?

And here’s another rub. There are three limitations on the amount which can be recovered against a license bond based on: (1) the period in which the license bond was effective; (2) the aggregate amount of claims against the license for any period; and (3) the type of claim being made against the license bond.

- Effective Period of License Bond: A license bond can be effective for a period as short as a year to as long as five years. A person making a claim against a license bond may only make a claim against the license bond(s) in effect at the time the alleged damage occurred. This may or may not be the same license bond which is currently in effect.

- Aggregate Amount of Claims: The current $15,000 license bond amount is the “aggregate” amount available to persons making a claim against a license bond, not the amount available for each claim. Thus, if you have multiple persons making claims against a license bond the aggregate amount available to those persons is $15,000, not $15,000 each.

- Types of Claims: Except for homeowners contracting for home improvements upon the homeowner’s personal family residence who have been damaged as a result of the contractor’s violation of the Contractors Licensing Law, the aggregate amount available to claimants for wages and fringe benefits is currently $4,000, and all other claimants is currently $7,500.

What happens if there are multiple claims which exceed the amount of the license bond?

If there are multiple claims which exceed the amount of the license bond, the bond will be distributed to claimants in portion to the amount of their respective claims.

Are their time limits for making a claim against a license bond?

How do you make a claim against a license bond and what can you expect when you do?

There are two avenues which can be taken to make a claim against a license bond: (1) file a claim directly with the license bond surety; or (2) file a lawsuit naming the license bond surety as a defendant. If you file a claim directly with the license bond surety you may be asked by the surety to complete the surety’s claim form and provide documents supporting your claim. Upon receiving this information, the surety will request that the contractor respond to the claim and there may be several back and forth communications as the surety collects information to evaluate the claim.

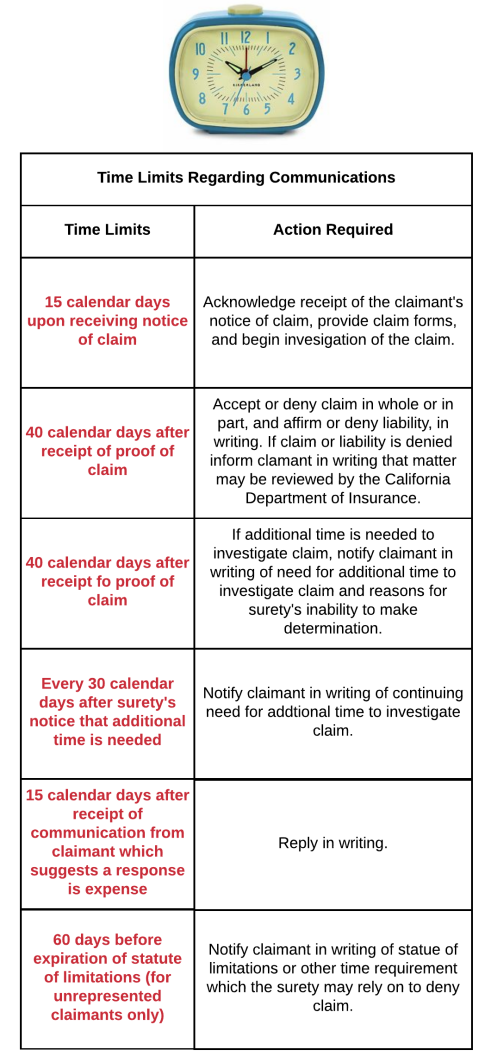

California’s Fair Claims Settlement Practices Regulations govern a surety’s obligations when investigating and settling a claim against a license bond.

What happens if a surety pays a claim against a license license bond?

If a surety pays a claim against a license bond it is required to give notice to the contractor that it intends to pay the claim. The contractor then has 15 days to protest the payment. If the contractor protests the settlement, the CSLB will conduct an investigation, and if the evidence shows that the surety has or will sustain a loss as a result of a good faith payment by the surety then the CSLB will take disciplinary action against the contractor.

If the contractor does not protest the payment, the surety is required to provide written notice to the CSLB o the payment within 30 days of payment. A contractor then has 90 days from the date notification that payment has been made to submit proof that it has reimbursed the surety for the amount paid. Most sureties require that a contractor sign a general indemnity agreement obligating not only the contractor, but the contractor’s principal, to reimburse the surety for amounts paid.

What happens if a surety denies a claim against a license bond?

If a surety denies a claim against a license bond the claimant may sue the surety in court. As a practical matter, if a claimant sues a surety in court, the claimant will likely file suit against the contractor as well. Also, it is not uncommon that a claimant making a claim against a license bond has also filed a complaint against the contractor with the CSLB. The CSLB and the license bond surety have independent investigative responsibilities, so just because the CSLB may find that the contractor violated the Contractors State License Law, doesn’t necessarily mean that the surety will as well.

27 Responses to “Shaken? Stirred? A Primer on License Bond Claims in California”

Hello Garret. This site is very helpful.

Re: a bond complaint filing, as the bond company has denied my claim based in part on their statement “it is not reasonably clear the bond principal violated Section 7109 for a departure from trade standards“, are “trade standards” clarified somewhere? I sent date and time stamped texts and photos of damage done and manufacturers specifications that were not followed, but the contractor has claimed their work was adequate.

They also told the bond company I hired a landscaper who blew debris onto the enclosed patio worksite and damaged their concrete. A lie. I have no such landscaper and the site was undisturbed. The contractor applied under high heat and dragged mud clods in on his spikes. But how should I prove a negative?

They also demanded additional payment to remove the surface they damaged and then left the site when I refused to pay more for them to correct the damage they acknowledged they had done. I never heard from them again.

I had to hire another company to remove the damaged floor and apply a new surface. I claimed this cost as damages and provided statements. The contractor claimed I hired someone else to do the floor instead of working with them But they walked and would not respond to my written letters.

The bond company has still denied my claim. I am going to contact the Dept of Insurance. But I don’t know what qualifies as “trade standards” or incurred damages if not this?

thank you

Unfortunately, sometimes even when you’re right (or at least think you’re right), you’ve got to fight for it, which is the case sometimes when it comes to license bond claims. Simply because a license bond surety denies your claim doesn’t mean it is the end of the road. You still have the ability to sue the license bond surety and contractor to ask that a court order the license bond surety to make payment under the license bond. To be sure, litigation can be costly as well as time consuming, and you’ll need to weigh whether that cost and time is worth it to you, although you would want to factor into this decision whether, in addition to suing the contractor and license bond surety under the license bond, whether to also sue the contractor for breach of contract in which your damages may exceed the $25K cap of the license bond. By way of example, if you believe that the contractor’s defective construction caused $50K in damages, you can sue the contractor for breach of contract to recover the full amount of your $50K in damages, but could also sue the license bond surety and the contractor under the license bond knowing that you would be capped at $25K. Knowing that you can sue the contractor for the full amount of your damages, in this example, could make filing suit worth the cost and time in doing so.

Hi – thank you for this article. This part was a bit confusing:

“If a surety pays a claim against a license bond it is required to give notice to the contractor that it intends to pay the claim. The contractor then has 15 days to protest the payment. If the contractor protests the settlement, the CSLB will conduct an investigation, and if the evidence shows that the surety has or will sustain a loss as a result of a good faith payment by the surety then the CSLB will take disciplinary action against the contractor.”

I am in the midst of claiming on the bond of a contractor who performed a roof install job that leaked and was not up to acceptable standards. I submitted the claim; and then the Principal made a protest via a large law firm. I submitted a rebuttal to that protest. The surety bond company then judged in favor of me, but gave the other side 15 days to respond. The Principal has responded with another protest from that law firm that contains fabricated assertions and that have little relevance to the actual bond claim. The bond company has rescinded the judgment. This whole process has taken the period of over 6 months, and the last thing I want is for this to continue dragging out.

I am confused by the passage in your article because the surety has not asked the CLSB to get involved at any point here (although I do have a separate open investigation with the CLSB that I am in the queue for that I initiated). I do not want to intermingle the CLSB’s investigation (which could take a long time) with the bond company’s decision. Could you help clarify what you mean by the CLSB will conduct an investigation, and do you have any thoughts on how best to deal with this situation and put pressure on the surety to provide judgement and make payment? I believe the surety has all the information they need in order to make the judgement.

Hi Mikey. While the CSLB enforces the Contractors State License Law (CSLL) and license bond sureties will make a payout for violation of the CSLL they have separate jurisdictions. The CSLB does not get involved in license bond claims and license bond sureties do not get involved in complaints filed with the CSLB.

Thank you for this article– it has been a lifesaver!

How many times can a Surety Bond request a 30 day extension for investigation?

The Bond has asked for another 30-day extension. This is now the third (3) request for a 30-day extension and I am concerned the bond holder is “running” down the clock on me to file a Civil Claim.

At this point I have been without a water main for 130 days (90 days worth of extensions plus 40-day of initial claim)

Can you please comment on how many times a 30-day request can be made by the Bond company?

Hi Gettis. Sorry for the delay getting back to you. You can find the Fair Claims Settlement Practices Act regulations online at: http://www.insurance.ca.gov/01-consumers/130-laws-regs-hearings/05-CCR/fair-claims-regs.cfm#surety. Take a look at Section 2695.10(c). Unfortunately, there’s no maximum number of 30 day extensions a license surety can request. However, they are required to “specify the reasons for the need for such additional time, including specification of any additional information the insurer requires in order to make such determination” as well as “advising the claimant of the situation and provide an estimate as to when the determination can be made.” If you think the contractor is “running down the clock,” so to speak, know that you have 2 year statute of limitations to bring a civil lawsuit for breach of oral contract and 4 years for breach of a written contract. Good luck to you!

I am going to file a bond claim against a contractor for failure to complete their work. I have spent a lot of time chasing the contractor and finding another contractor to complete the work. Is payment for my time/mileage etc. an allowable cost in the claim under California rules/law.

Mike, statutory law doesn’t expressly define what types of damages a license bond surety is liable for. Your time, mileage, etc. would likely be considered what we attorneys call “consequential damages.” Consequential damages are damages that arise as a consequence of an act or omission or breach of contract by a contractor, as opposed to “actual damages,” which are damages that arise directly as a result of an act or omission or breach of contract by a contractor, like correcting defective work. As you might guess, consequential damages are more difficult to recover than actual damages. So, bottom line, you can claim your time, mileage, etc., but it may difficult to convince a license bond surety that they should pay for it.

Thank you for the bond primer Garret. I have a CA small claims judgment against my contractor for 10k. I did not go after the surety company. The bond was effective from Nov 2016 and cancelled Nov 2018. The damage occurred during this period and there are additional damages that were not claimed. The contractor currently has a bond with a new company that went into effect Nov 18. Is it correct that I would be restricted to go after the NEW surety company either in a claim or suit since damages existed before they were on board to cover the contractor ? What about the bond company that he held during the damage period–does the statue of limitations start to run from license period expiration date (at earliest: either the min. bond coverage of one year from Nov. 2016, so Nov 2017–I would have until Nov 2019 to file suit or at the latest: two years from date of cancellation–so, Nov 2020) ? Thank you for the guidance. It would have to be in superior court since the guarantor is a business and myself the homeowner should I want to exceed the $6,500 cap?

You can certainly tender a claim with the license bond surety, in which case, it would the surety who issued the license bond during the time that you were damaged and you would have have until two years after the license bond expired to bring such a claim; but you actually have a better solution. Send a letter to the CSLB enclosing the judgment, together with the name and contractor’s license of the contractor. The CSLB will then send a letter to the contractor giving them 90 days days to satisfy the judgment or the CSLB will suspend the contractor’s license. This is an effective remedy against contractors who are continuing on in business. Less effective, obviously, if they’ve gone out of business – http://www.cslb.ca.gov/Consumers/Legal_Issues_For_Consumers/Civil_Judgments.aspx

Hi Garret. My bond claim has been denied by two different sureties. One held the bond when the contract was entered into and performed and the other held the bond when the damage occurred and the poor workmanship was discovered. I’m trying to understand the “license period” language. This is the time frame for the actual contractor’s license? I don’t see the license period info on the CSLB website, just the bond info, so I’m wondering how to find out when the contractor’s license expired?

The “period” refers to the period in which the license bond was in effect. License bonds can be effective for as short as one year to as long as 5 years. A person making a claim against a license bond may only make a claim against the license bond(s) in effect at the time the alleged damage occurred. You can find information on a contractor’s license bonds by searching for the contractor on the Contractors License Boards website and then clicking “Contractor’s Bond History.”

Hi Garret. If a project was performed over multiple years, can you go after $15,000 for each bond in effect in each year of the project, or are you limited to $15,000 across all years?

It depends. A claim can only be made against a license bond in effect at the time damage occurred. That could be one bond, but if it’s continuing damage, could potentially be against several bonds.

So the $15,000 bond is only for homeowners constructing improvements to their family residence; For everyone else injured by the licensee it’s a $7,500 bond? That doesn’t seem fair.

What recourse is available when a surety company denies the claim over the phone within twenty-four hours of receipt with no investigation? I’ve asked in writing for them to follow through in writing with the denial.

Does this fall into the 15 or 40 day timeline?

Is there a regulatory agency that monitors this in California?

Hi Catherine. If they denied your claim it should be in writing. If not, you can file a claim with the California Department of Insurance – https://www.insurance.ca.gov/01-consumers/

If the work was done 10 years ago and has a lifetime warranty that the contractor wont honor can I still make a bond claim?

Hi Mark. Sorry for the late reply. A license bond claim is separate from a warranty claim. Thus, if you have a warranty claim you can bring a lawsuit against the contractor if the contractor does not honor the warranty but you wouldn’t be able to bring a license bond claim.

My friend has a judgement for unpaid wages for 13k and it is a year old. Does he have any recourse?

Hi John. Under Business and Professions Code section 7071.17 you can send the judgment to the CSLB and the contractor’s license will be suspended unless the judgment is paid.

What happens if the contractor files bankruptcy and has a judgment against him?

Hi Rick. It depends on which Chapter of bankruptcy you file under and whether the judgment is dischargeable or non-dischargeable. This might help – http://www.nolo.com/legal-encyclopedia/will-bankruptcy-get-rid-lawsuit-judgments.html

As a general rule, the cost of filing and pursuing a claim against a $15,000 license bond will be X times the amount recovered, where X = a painful multiplier.

Couldn’t have put it better.

Could you explain what this means in terms of the multiplier? Do you mean in court? What multiplier can you expect if you take a bond company or contractor to court if the bond company isn’t paying out on their claim?

Hi Mikey. I’m pretty sure what was meant by – “As a general rule, the cost of filing and pursuing a claim against a $15,000 license bond will be X times the amount recovered, where X = a painful multiplier” – is that if you hired an attorney to pursue a claim against a $15K license bond you would likely spend more in attorneys’ fees than what you would recover. The attorneys’ fees is the “painful multiplier.”